Famous Celebrities Teach You Budgeting Lessons

Many of us wished to be rich and famous when we were younger. It may surprise you to know that many of the rich and famous make smart decisions with their money. In those dreams, you have a lot of money that you spend on houses, cars, vacations, and clothes. No matter how much money you may have, you should always create a budget. Even if you have a large amount of money, you want to know how and where you are spending it.

Celebrities’ Budgeting Lessons

We have all seen celebrities spending large amounts of money in many places. We see less of the celebrities that are spending less money and making smart choices. This article is going to focus on celebrity-inspired tips for budgeting your money.

Lesson 1 - Have More Than One Stream Of Income

One of the most important budgeting lessons you can learn is that you should not spend all of the money you earn. Rob Gronkowski and Jay Leno are two celebrities that do not spend all of their income from one job. Instead, they pick one of their sources of income and live off of that income. They save or invest the other income that they earn. There are actually two important lessons to learn from this:

Image Source: Wikipedia

Always Have A Few Streams of Income

The first is to make sure you have multiple sources of income. It is an obvious statement, but I am going to say it anyway. The more income you have means the more money you have. The more money you have means the more you can save. In addition, you never know when one of your income streams may dry up. If you have multiple streams of income, you can handle it when one source is not as lucrative.

Image Source: 313 Presents

Spend Only One Income Stream and Save the Rest

The other important lesson is that even though you may bring in a large amount of money, you should not spend it all. You should pick one of those income streams and live off of that. You can save a lot of money and you know how much money you need to live.

Lesson 2 - Live Modestly

Another one of the best budgeting lessons comes from none other than Warren Buffett. He is known to be the richest man in the world with an amazing fortune consisting of many billions. Even though he has a lot of money, he does not spend it all. He lives modestly of a very small percentage of his wealth. He still lives in the same house he bought in the late 50s. He has chosen to live off of less than one percent of his total wealth.

Save Your Money!

The lesson to learn from this is no matter how much money you make, you should not spend it all. You must begin to save money as soon as you earn it. You should pay yourself first before you pay anyone else. You should put a set percentage of your paycheck into your savings account with each check.

Lesson 3 - Spend Less

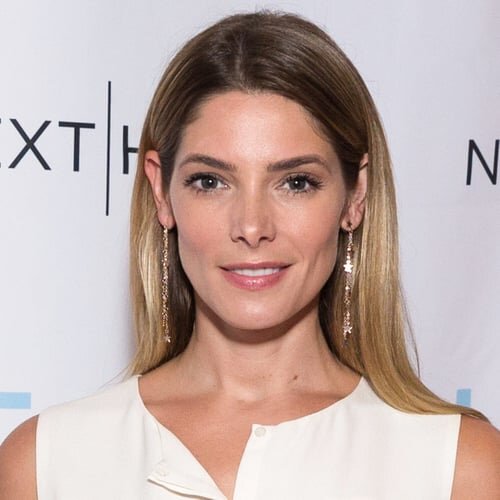

Image Source: Pop Sugar

Another one of the great budgeting lessons is that you should spend less save more. Actress Ashley Greene learned many lessons about money from her family while she was growing up. Their family taught her that she does not always have to buy the most expensive item.

For Ashley, in particular, she knows that her job can be hit or miss. She knows that when she is working, she can make a lot of money. However, there are times when she is not working and she needs to have money to cover it.

Be Aware of the Uncertain

As a result, she makes it a practice to spend less money. If you have a job that does not have a consistent paycheck, you may want to be extra careful with the money you earn and how you spend it. You should think about how much money you really need to live and determine how long you might be out of work. This can help you figure out how much money you need to have saved for when you are out of work.

Lesson 4 - Coupons

Image Source: Insider

What do Kristen Bell and Carrie Underwood have in common? They are next on the list of budgeting lessons. No matter how much money they earn, they still use coupons. They are not ashamed of their coupon habit. They are proud. They are saving money and should be proud of that.

Using coupons is an easy way to save money, especially today when most of them are electronic. You can even download apps that will help you find coupons and even find the best ones. You can keep them all electronically and access them when you need them. We all know that stores mark up the price of items to a ridiculous amount. If you can save yourself some money, then why should you not?

Have a Spending Plan

Image Source: American Idol Wiki-Fandom

The stores put out coupons because they want you to come to their store to use them and spend money. While you are there, they hope you will spend more money than you planned. You can stop that, too. Before you go into a store, you should know exactly what you want to purchase. Do not deviate from that decision. There is always a chance that you may see something you love and it is one of a kind that you will not be able to find again. You can set aside some additional money for a purchase like that.

For this to work, you have to have a set amount that you can spend. This money cannot interfere with your budgeting plans. This cannot be money that is needed for expenses. It also cannot be money that is intended for savings, unless you have savings specifically for this type of spending.

Lesson 5 - Sales

There is no honor in paying the absolute highest price you can find for an item. Sure, it might be some type of status symbol to be able to pay the highest price for something, but honestly, if you can find it on sale, it is foolish for you to pay a higher price. Do not get caught up in the way it looks to others how you spend your money. It is your money and you are the one that can protect it to ensure you will always be able to pay for your needs.

Some people make it a game to see how low of a price they can purchase something. Others will not buy anything if it is not on sale. You should try to make an effort to only purchasing items if they are on sale and see how it works out for you. That may mean you have to buy a different brand than what you are used to at the grocery store, but you also may find something new you like.

Budget Better. The Budgetry Store Is Here To Help.

Lesson 6 - Try Fixing It Yourself Before Buying New

Tyra Banks is known to be frugal, but one of the areas where she is the most frugal is replacing items. Before she gives up on something, she tries to fix it, or improve it in some way. Society today has become a throw-away society. We are quick to dispose of something and replace it instead of seeing if it can be fixed.

Most of the time a simple fix will make an old item like new again. If you take a little time and work on an old item, it can be better than it was before. Many older items are built better than items today. If you can repair or refurbish an older item, you may be better off than buying a new one, which surely will not last as long.

Lesson 7 - Make Use Of Gifts And Free Items

Image Source: CNN

Accept gifts from people. I am not suggesting that you harass people for gifts, but if they want to give you something, then accept it. Some celebs got their best items as a gift from another famous friend. You do not have to let your pride get in the way.

Also, If you go somewhere and there are free samples, take them. Tyra Banks is also known for taking the free soaps and lotions from the hotels where she stays.

The hotel puts them out for you to use, so you should use them at some point.

The Importance Of a Budget

If you do not have a budget, you are probably spending too much money. One of the best ways to allow your spending to get out of control is to not have a budget. It is hard to reduce your spending, especially if you are used to spending whatever you want at any time. There are some signs that it is time for you to create a smart budget.

If you are stressed or worried about money, it is a sign you are spending too much. If you do not have any money saved and you have bad credit, it is time to change your spending habits. If you own a lot of items that you do not need, or you eat out all the time, there are ways to change your spending and create your budget. When you are beginning to work on a budget, there are a few budgeting lessons that you need to learn along the way to make it easier for you.

It is going to take a lot of consistent effort from you to change your spending habits. When it gets challenging for you to stick to your plan, you will need to remember why you wanted to change your spending habits in the first place.

How To Create a Budget

One of the first budgeting lessons you need to learn is how to create a budget for yourself or your family.

Consider a Weekly Budget

If you are new to budgeting, you may want to consider a weekly budget. This type of budget is the easiest to manage and update as you need to. With a weekly budget, it is easy to see if you have chosen the wrong path for yourself and need to change course.

Set Goals

When creating any type of budget, you need to understand your goals. You need to know if you want to pay off debt, save money for retirement, save for emergencies, or save for an immediate need. Perhaps you want to do all of the above. Once you know your why, it is easier to create goals to get there. Once you determine your goals, you can set a timeframe and amount of money to them.

Once you have determined these things, you must then take a hard look at your income and your spending. This gives you a good look at your expenses for the week, the month and the year. This allows you to determine how many of those expenses are actual expenses that you have to pay and how many of them are expenses that you can eliminate.

Conclusion

I have given you some solid tips on budgeting from the stars. They may seem like unlikely candidates to give advice on saving money, but perhaps, they are exactly the right ones. I think we make a lot of assumptions about the rich and famous and how they spend their money. They are based on what we see on tv or social media and it is not the best way to understand someone.

Regardless of who is giving the tips mentioned in this article, they are sound tips about budgeting and saving money. If you want to have control of your money and put yourself in a better financial position, you have to consider creating a budget. It may be difficult at first, but it will put you on a path to saving money to buy the items you want when you can really afford them. Perhaps by then, after you do all the saving, you may realize you do not really want those things anymore. When you learn to control your money instead of letting it control you, you have begun to put yourself in a much better place.