Small Business Budgeting

Do you know the number one reason motivated individuals embrace the risk and commit to the effort of starting their own business? It’s because they love paperwork – paying utility bills, sending out third copies of invoices, managing payroll. They simply can’t get enough balancing of checkbooks and resolving accounts with their personal monthly budget, and they can’t make tax time come more than once a year, so they bet their entire lives on a few rolls of the entrepreneurial dice just so they can create a business budget or two.

Oh, and they have to come up with a service or product or something to offer as well, just so they’ll have something to do a monthly business budget about.

It’s absurd, right? Small business budgeting is an essential part of running a business, but it’s never why small business owners do what they do.

We’d all like to make a reasonable profit, sure. We’re thankful when we have enough to pay the bills and meet payroll each month. But budgeting for business owners is kind of like doing the dishes after a holiday meal – we recognize that it’s part of the gig, and we’re happy to do it, but that’s not really the primary reason we got together, and it’s certainly not why we spent all day cooking.

Imagine the first generation of housewives (because that’s who generally got stuck cleaning up at the time) provided with automatic dishwashing machines. Sure, they were still involved in making decisions about which things were going to go in, when and for how long they’d be there, and how to best put them up afterwards. The bulk of the heavy lifting, however, was now handled by technology. The same person was still in charge; that part of the job, however, was suddenly much, much easier. She could now devote more time and energy to matters of greater importance.

It’s the 21st century, and small business budgeting doesn’t have to be done the old way anymore. Sure, you could pay someone to handle your company budget, but it’s hard enough to make a profit these days, and besides, you like to stay “hands on” when it comes to finances.

Still, you didn’t exactly sign up to spend half your day juggling numbers.

It’s borderline irresponsible not to at least consider some of the amazing apps and small business budgeting tools available online. You know better than most that “time is money,” and that’s never been more true than it is in today’s small business climate. Like the dishes, carefully managed business budgets may be an essential part of moving forward and keeping your vision growing, but that doesn’t mean they can’t be managed more efficiently. In fact, the right business budget app might do more than help you accomplish the same things in less time – it might help you manage your small business finances better.

Whether it’s your household or your corporation, making an initial budget can be as emotionally draining as it is mentally tiring. Every dollar of income, every obligation, every invoice, every regular monthly expense and unexpected outlay has to be accounted for – in general terms at the very least – before you can even begin thinking about planning the next month, six months, or year.

It can be sobering when we first begin to document exactly how we’re spending our money, whether as individuals or business owners. Most of us think we know what our priorities are, but when our spreadsheet suggests otherwise, we may have some soul-searching to do. A good budget also requires adjustment from time to time. At first, it may be weekly, then monthly… eventually you can revise your figures annually based on what you’ve learned and what you want to happen next.

Technology won’t make it all magically go away, but neither will ignoring it. What it can do is help you create a business budget built from small business budget examples that have worked for others in similar positions. Using technology to support your small business budgeting can make your time more efficient and the results more useful, making your monthly budget another tool working towards the success of your business instead of simply one more headache to deal with before getting back to what you really want to be doing.

Think of all the things that seemed far-fetched or even impossible not that many years ago. And yet, here we are, communicating over a device that can store everything we’ve ever read, written, or otherwise created, search the world’s knowledge bases, and produce endless funny cat videos. For some of you, it also makes calls and takes pictures. So yes – it’s much easier than it was a generation ago to get your startup budget going more effectively than you could with a broken pencil and old legal pad.

They say time is money, and if you’re a small business owner, you probably never feel like you have enough of either. The number one thing any small business budget planner or business budget app should do is reduce how long it takes to organize, analyze, and store your costs, balances, obligations, and invoices. If you’re an experienced business owner, you already know what needs to be done – you just need an easier, more effective way to do it. If you’re new to running your own business, you need access to straightforward, cut-to-the-chase articles and explanations, and small business budget examples which you can adapt as templates for your own or toss them and start from scratch based on what you’re learning. Whether you’ve been operating with a monthly business budget system of your own for years or you’re planning your first startup budget, you small business budgeting tools have to be flexible and powerful enough to handle your particular circumstances and serve your specific goals, but streamlined and intuitive enough that they don’t require more time to learn than they save by using them.

Few things are more frustrating in small business than avoidable errors or unnecessary waste. Not many things about running a business are easy, and almost none are predictable. All the more important, then, that we control the parts we can. Keeping up with due dates, tracking upcoming expenditures or outstanding invoices, catching spikes or errors in our utility bills or other recurring expenses. Automating and streamlining as much of the “grunt work” of your small business financial budget doesn’t solve all of your problems, but it reduces many of the less productive stresses that are interfering with your focus and peace of mind – not to mention your bottom line. Your business budget is a necessary part of small business success, but it’s not the goal. It’s not even the fun part. It can, however, make the fun parts possible.

Running your business is never just about money, but there’s no getting around the value of every dollar in or out. Too often, any self-evaluation of our finances ends up reflecting more about our emotions, perceptions, and opinions that where our money is actually coming from and where it’s actually going. This is one time that the cold, dispassionate analysis only technology can offer can more effectively highlight unrecognized success and unnecessary inefficiencies. What you choose to do is always up to you. You’d doubt the expertise of any doctor, however who didn’t do a proper examination before prescribing treatment, or a mechanic who didn’t run some tests on your vehicle before starting to replace parts. We owe it to ourselves to access the sort of data and insights available in the 21st century before making major decisions about the future of our business.

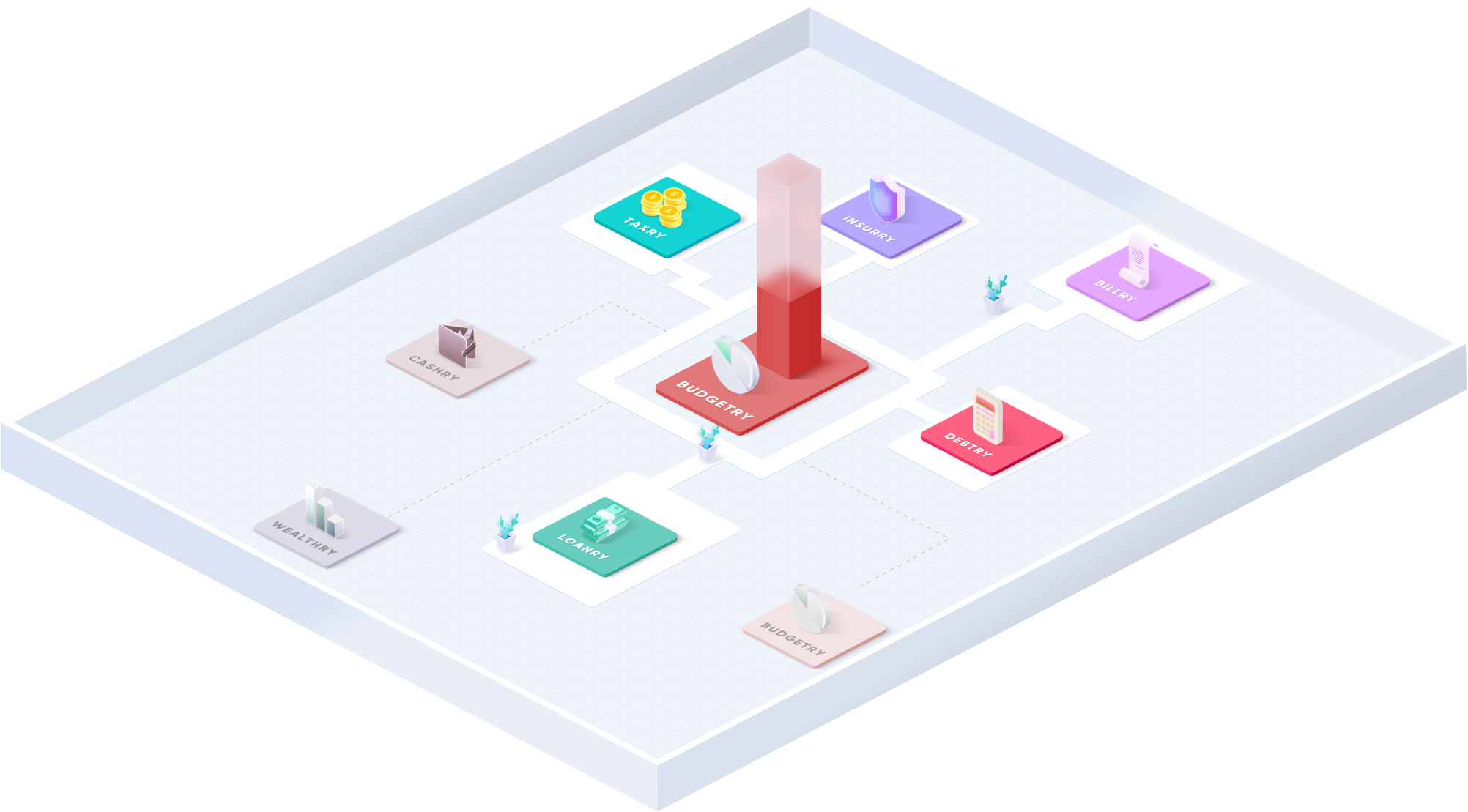

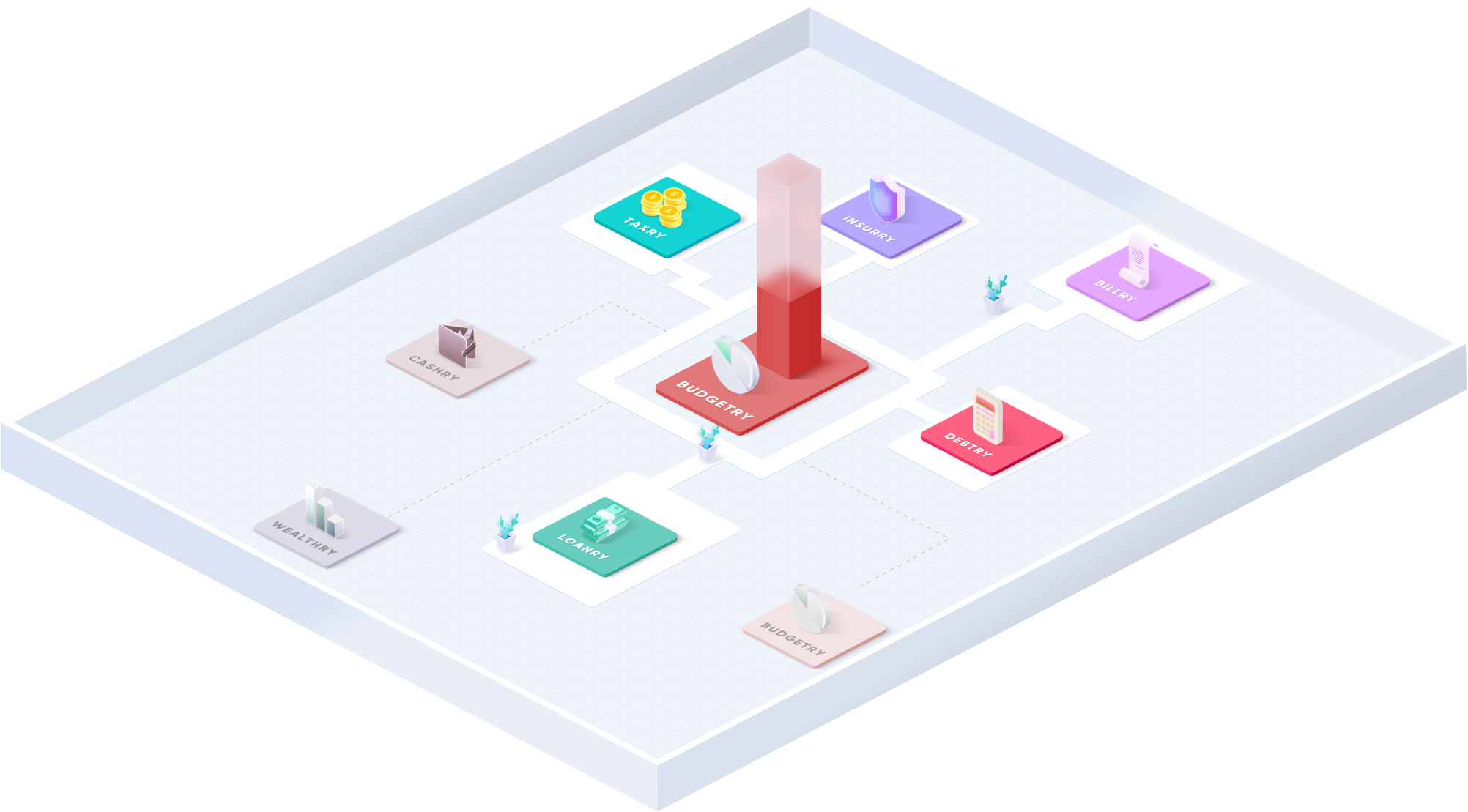

If you’re visiting today because you’re looking for better ways to manage business budgets or exploring online tools or apps that assist with budgeting for business owners, we’re glad you’re here. We’re in the process of rolling out our own small business budget planner and business budget app, redesigned to benefit from the collective experiences of the first-generation options already out there. As with everything we do, our goal is to offer you enough power and flexibility to manage your specific circumstances while keeping things simple and intuitive to use. If that’s you, and you’re content to stay in this part of our Goalry Financial Mall, that’s wonderful. Welcome. We’re glad you found your way to us, and we’d like to do whatever we can to help while you’re here. We want you to know, however, that Budgetry is only one important member of the larger Goalry family. Signing up to use any of our free tools and services gives you access to the entire Goalry Financial Mall. If you’re looking to organize your personal finances while improving your small business’s fiscal efficiency, you’ll find information, tips, and tools at Budgetry’s sister site, Billry. If you’re looking to purchase equipment, expand your business, or simply need a seasonal loan to push through to the end of the current crisis, we have insights and connections at Loanry that you might wish to consider. Taxry can help with figuring out your small business obligations to employees as well as Uncle Sam, and Wealthy is all about investing towards retirement on the off chance we all reach that someday. Understanding property values, deciding whether or not a home equity loan makes sense for your family, or just looking for tips on finally paying off those high-interest credit cards – we have experts who can help. Everything is free to access and shared in plain, simple English.

We have this crazy idea at Budgetry, and across the Goalry family, that while creating a business budget or effectively analyzing business expenses may not always be easy, it doesn’t have to stay as complicated as it often seems. We believe that with the right information, tools, and connections, most of us are perfectly capable of taking more effective control of our personal and small business finances.

That’s why we’re committed to the continued growth of the Goalry “finance mall” – ten interconnected “finance stores”, each designed to simplify your personal or small business finances. Whether it’s real estate, taxes, investments, budgeting, debt management, loans, or simply checking your credit score and credit report, Goalry means access, information, and connections to the services you decide you need.

You know your small business. Whatever it is you provide, do, or make, you’re the expert. We know small business finance. Loans, budgeting, taxes, investments – it’s what we do. How? We bring together experts from every financial field and tap their knowledge and experience for the most essential insights and information, then share it in plain, simple English through our blogs, informational articles, and videos. Where you go, when you go there, and what you do when you get there is always entirely up to you.

Imagine looking over invoices and starting to wonder – are we spending way more on Item A than we used to? Does it seem like Income B naturally dips a little every year about this time? What about that thing we started doing a few months ago – has it led to more of Outcome C?

Imagine if, instead of guessing, or – worse – devoting the rest of the day to trying to figure it out, you could simply call up those factors on your desktop, iPad, or smartphone and visualize the results any way you wish? Imagine quickly and easily identifying relevant trends or uncovering possible trouble. That’s smart small business budgeting.

Imagine an opportunity has presented itself unexpectedly. It will require some risk and additional investment, but then… that’s what you do, isn’t it? What you really need to figure out is whether or not Payment Option X will still allow you to meet Fiscal Obligations Y while reserving enough to handle Situation Z.

Imagine if instead of having to spend the day trying to reach your accountant and find a time you’re both available so you can explain what you’re hoping for, you could easily pull together your various balances, your obligations for the next six months, and your projected income based on the past five years – all with a swipe or a few clicks. Imagine making more informed decisions in less time. That’s smart small business budgeting.

Imagine easily categorizing purchases and other spending as you go, as easily as you respond to a text or check social media. Budget categories can be as general or specific as you like. File a purchase under “Office Supplies” or break it down into “Supplies” - “Office” - “Writing Utensils” - “Ballpoint Pens (Black).” Categorize expenses as “Travel” or as “Research” - “Travel” - “Lodging” - “Extra Fluffy Pillow Rental." Enter them any way you like, or simply take a picture with your phone like you do when you make a remote deposit to your bank.

Imagine automatically generated spreadsheets for easy analysis, figuring quarterly taxes, or planning expansion. Imagine visualizing the same information as pie charts, graphs, year-to-year or quarter-to-quarter comparisons, on whatever scale you choose. You can even pick the colors if you like.

Imagine multiple employees easily categorizing and automatically sharing their own travel, expenses, and projections on any laptop or smartphone. Imagine pulling up spending reports, budget projections, or documenting fiscal trends with a few swipes or clicks on any device.

Imagine alerts on your phone or laptop when invoices are coming due, utility bills show a significant increase (or decrease), or important payments have cleared.

Imagine sharing selected financial records with a few simple clicks or locking it all down against possible intrusion with cutting edge cyber-security.