The Ol' 50/20/30 Budget Rule Really Works

Most people don't learn enough about finances and budgeting when they are in school, and then they struggle when they are in the working world and trying to take care of all their own needs. They don't understand how to make a budget and control their finances, which makes it difficult for them to make goals.

Making goals is important, because it's how people make their lives better. Some important goals most people need to think about include buying a home, taking care of a family, sending children to college, and saving for retirement.

At least when people are making a lot of money, they can hire people to help with their finances. When you don't make a lot of money, you feel as though you are spending your money as soon as you make it.

There doesn't seem to be much point to a budget, because you are already using all your money as soon as you get it. Fortunately, anyone can learn how to make a budget, even if you don't have a high income. For example, by using different budgeting techniques such as 50/30/20 budget rule or any other.

You will find once you are living within a budget that you are able to start thinking about your personal financial goals.

50/30/20 Budget Rule

It is fair to say that following the 50/20/30 Budget Rule would help you reach your financial goals. But first,

What Even Is the 50/20/30 Budget Rule?

The 50/20/30 Budget Rule was created by Senator Elizabeth Warren and her daughter Amelia Warren Tyagi in their book All Your Worth: The Ultimate Lifetime Money Plan. In their book, they explain how the 50/20/30 Budget Rule works. According to Senator Elizabeth Warren and Amelia Warren Tyagi, you should be spending 50% of your income on Must-Haves, 30% of your income on Wants, and 20% of your income should be put into Savings. Instead focusing on strict budgeting, the 50/20/30 Budget Rule focuses on balance.

Must-Haves

Must-Haves include any of the necessary expenses we mentioned above, such as rent, utilities, groceries, internet, and any loans you have to pay back. These are expenses that you have to pay no matter what. Though some of these expenses vary slightly month to month, such as water or electricity utility bills, some of these expenses are fixed, such as rent. Don't forget, some of these bills, such as internet and loan terms, may be negotiable, so you may be able to lower some of these bills, even if you can't get rid of them completely.

Wants

Wants include things that you enjoy but don't fall into your Must-Haves. This could include expenses like going out to eat or going to the movies. These things do not need to be completely cut out of your budget in order to be financially stable, neither should they be. The key to Wants is moderation, and they should only take up approximately 30% of your income. Enjoying life is just as important as earning money, but you don't need to use all of your money in order to have a good time.

Savings

Savings is always a good idea, whether you are saving for a trip, for a big purchase -- like a home or new car, or if you are just saving for an emergency fund. Regardless of your reason, it is a good idea to put 20% of your monthly income into Savings. You never know what will happen, and you don't want to get caught in a tight spot, especially when it could be easily avoided by saving just a little bit every month, instead of blowing your money on unnecessary things.

Making a Budget With Little Income

Everyone can do better with a budget, but you just have to make the effort to get started. A budget isn't something to be afraid of or nervous about. Many people are worried that living within a budget means that they are controlled by their finances, and they feel like that is too stressful. Instead of thinking that your finances are controlling you, think about how much control you will have over your life when you are in control of your finances.

It also seems impossible to make a budget with little income. It is actually even more important to have a budget when you have less income. There may be some sacrifices involved in your new budget, but you and your family will be the ones reaping the rewards.

What Is a Budget?

The first thing you need to think about before you get started is what a budget actually is. Once you conceptualize it, you will find that it is easier to work with a budget and make the right decisions about your finances.

In short, a budget is simply knowing how much income you take in and how many expenses you owe, and then finding a balance between the two.

Your income includes any money that you can count on taking in, including your pay from work, child support, alimony, a side job, or even a regular gift you get from a grandparent. Expenses will include any money you can count on putting out, like your rent or mortgage, utilities, internet, food, clothing, transportation, and any loans you are paying. There may be other regular payments you have to make, like child support or educational fees.

Once you have a budget, you can start making your way toward financial independence. It will help you, especially if you are underpaid or if your income fluctuates. You need to know where your money goes so you can start achieving your financial goals.

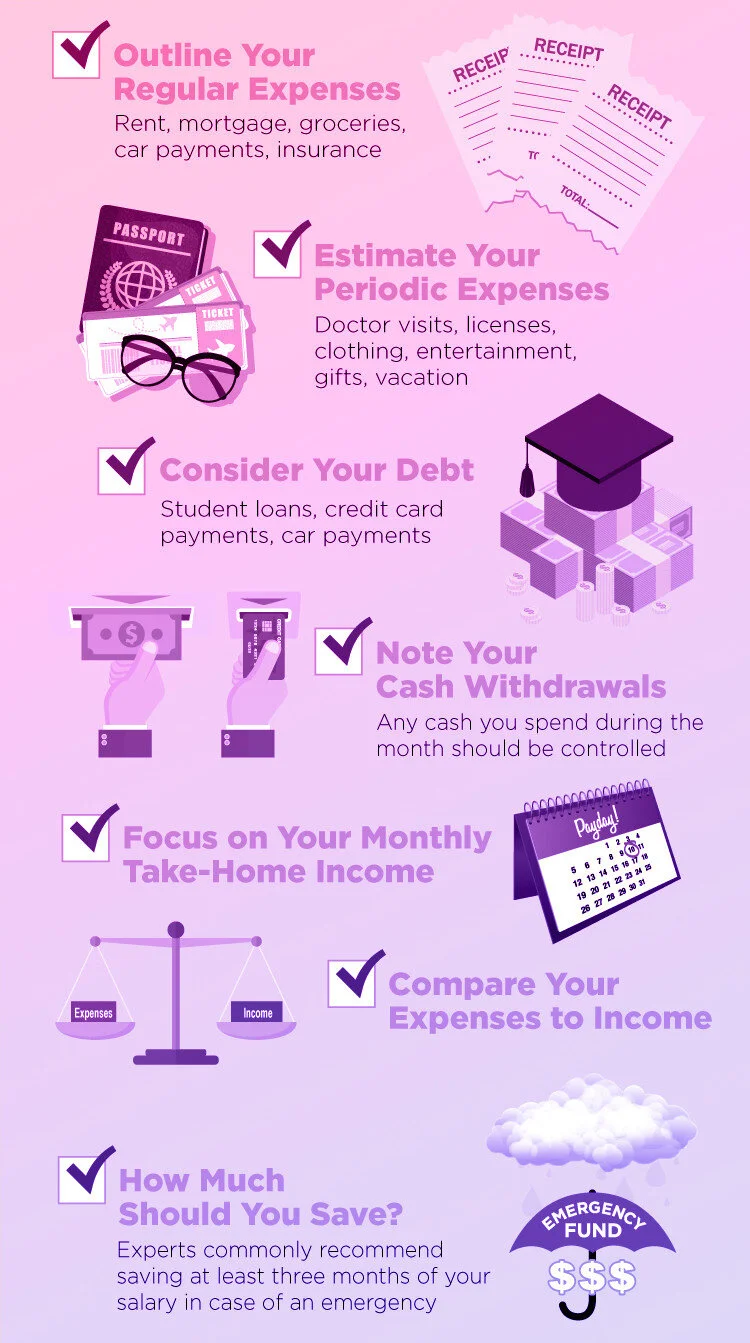

How To Get Started?

Especially if you haven't dealt with money very much before, creating a budget might seem overwhelming. You can take it one step at a time, and have a plan before you start. There are also apps and sites that can help you get started and organize your financial information.

1. Gather Your Financial Information

This is the first step you need to take. Not only will it help you feel more organized, but you will also be able to get more accurate numbers if you have the paperwork. Some bills vary, even a lot, like your electric bill. Separate your income from your expenses, and also collect your bank statements, tax returns, and any other financial information you have.

2. Negotiate Your Bills

While you are in the process of gathering your information, be honest about how much you are spending. You might be paying for services you don't use, such as a gym membership or cable channels you don't watch. If you have cable TV or internet services and want to keep them, you might be able to get your bill lowered by simply calling and asking.

Sometimes they think that they are about to lose you as a customer, so they are willing to give you a break. If you have loans or credit cards, you can call and ask if you can have a lower interest rate or fewer fees. It doesn't cost you anything to ask.

If you are interested to apply for a loan, enter your information below, and wait for potential offers within the next few minutes. Start here:

3. Set a Daily Expense Amount

There are some daily expenses, like food, that will vary. You need to decide on a reasonable amount to spend and stay within that number. If you go out to eat a lot, you should consider cutting back. You can stay within your budget if you are really committed to your own financial independence.

Some Tips For Building Your Budget

At first, you are just gathering numbers, but then you have to organize and prioritize your expenses and bills. The first two big categories of bills will be essential and nonessential bills because you are bound to have some unnecessary expenses. Add up all your expenses, and figure out how much of that is essential and how much is nonessential. Also, add up how much income you can expect every month. It will be easier to find places to cut when you are honest with yourself.

Here are some of the best tips for building your budget:

1. Keep Track of Your Money

This sounds obvious but it is harder to do than it sounds. Especially if you haven't been using a budget, you probably find yourself running out of money before you expect and wondering how you spent the money. Or you may even bounce a check every now and then because you thought you still had money in the bank. Keep track of everything you spend, and save your receipts and bills.

2. Be Reasonable

You may want to fulfill all your goals at once, but keep your budget reasonable. If you make it too hard to follow your new budget, it will be worse than having no budget at all. You will only be setting yourself up for failure, after which you may have trouble getting yourself to start again. Make sure your budget includes everything you really need, and focus on paying off debts when you can.

3. Focus on Needs Not Wants

You probably have a lot of spending habits for items you think you really need, but you will have to make some choices about getting rid of certain things you don't really need. You won't have to be as frugal forever; once you have your debt under control, you will have more discretionary cash to spend.

One big expense is cable TV, especially when many people find themselves not really watching it. Watch movies online and borrow videos from the library. When you go grocery shopping, make a list of everything you need beforehand and don't buy anything that is not on the list.

4. Set Your Goals

You will have a much easier time making sacrifices when you can see what you are working towards. The more specific you are, the better. You may be saving for a down payment on a house or trying to get through Christmas without accumulating debt. This is a good time to start thinking about whether it would help to have extra income. Perhaps you could get a flexible part-time job, sell some of the old things you don't need, or do some freelance work.

5. Make Some Big Choices if You Have to

Is your home bigger than you really need? Could you take on a roommate to help with expenses? Would it be less expensive to take public transportation instead of owning and maintaining a vehicle? You have to consider your options and any hidden costs that will accompany any changes you make.

6. Create Savings for Emergencies

A minor emergency is a big deal when you are living hand to mouth. Make room in your budget so that there is a little set aside in case your tire blows out or you experience another kind of emergency. It helps to have a long term savings account and a short term savings account so your minor emergencies won't interfere with your long term goals.

7. Avoid Unnecessary and/or Expensive Purchases

You may enjoy theme parks and movie trips with all the trappings, like popcorn and soda. But there are other ways to have fun that are free or at least much less expensive, like plays, musical performances, and free museum days. Check your local paper to find entertainment. You'll be surprised how much is going on.

8. Find a Better Way to Save

Follow the 50/20/30 Budget Rule no matter how much money you make. 50 percent of your income should go toward your needs, 30 percent of your income should go to the things you want, and the final 20 percent should be diverted into savings. The 50/20/30 Budget Rule is a good guideline to help you meet your goals.

Especially when you first get started, it may seem difficult to follow the 50/20/30 Budget Rule. It is easier to get yourself accustomed to following the guidelines if you actually work with cash for a while. Put the amount of money you are allowed to spend in one area in an envelope, and when the envelope is empty, you are done spending in that area until next month.

The Three Different Kinds Of Budgets

There are basically three different kinds of budgets, and you can change what kind of budget you are using when you have different needs and goals. These three kinds of budget cover all the aspects you need for personal financial budgets.

- The Planning Budget

This is the kind of budget you need if you are saving up for something specific, not for general long term goals like retirement. You can use a planning budget to get the money you need to pay for a wedding, buy a car, or save up for a down payment on a home. The first step of a planning budget is to set your goal, so you may need to do some research on how much money you will actually need. For instance, if you are saving for a home, find out how much homes in your area cost, mortgage rates, and how much a down payment should be.

Then look for places in your budget where you can cut down expenses to reach that specific goal. You can probably keep your regular budget without too much work, and just put money into savings for your specific, temporary goal. - The Problem Solving Budget

The problem solving budget is also exactly what it sounds like. A problem solving budget is focused on an area of your financial life where you have a problem, and you develop a plan to deal with it. If you are not ready to create an entire budget yet, you can start by working a problem solving budget first.

One example of a problem you can solve with this kind of budget is overspending on fast food. This is a weakness for most of us, so there are a lot of tips people can give you on how to conquer this area of your life. For instance, you can pack your lunch with inexpensive, nutritious food if you plan ahead. If you drive by your favorite fast food place on the way home from work, take a different route. If your problem is that you get tired at the end of the night and don't want to cook, prepare food on the weekend so you won't have as much to do when it's time to make dinner. - The Comprehensive Budget

This is the budget that takes the most work but puts you most in control of your financial life. With the comprehensive budget, you can completely revamp your finances. For the comprehensive budget, you will need to make a list of all your income and expenses. After that, you will find ways to cut down on unnecessary expenses, start living within your income, and ultimately save by using the 50/20/30 Budget Rule.

How To Create a Comprehensive Budget

At this point, you are probably hoping for some guidance on how to create a truly comprehensive budget. There are some steps you can follow that will help you create a budget for almost anything.

Gather Information

The first step when creating any kind of budget is gathering all your financial information. This includes all your income, including pay stubs, child support, and any other income you receive on a regular basis. You also need to gather documentation of all your expenses, including:

your rent or mortgage payment

utilities, like electricity, water, sewer, and trash

internet and/or cable

groceries

eating out money

household maintenance expenses

subscriptions

monthly payments for loans you already owe

and any other expenses you pay every month.

You may forget something the first time you try to make a budget, but that's all right. It takes a while to get into the habit of really noticing all the money you spend.

Organize Your Information

There are helpful apps and spreadsheets you can use, or you can just keep your income and expenses on notepaper in different lines. Either way, you need to be able to look at the totals and see what the difference is. Do you make more than you spend? Or vice versa?

Knowledge is power, and you should be glad of whatever you learn. If you are living outside your means, it is great that you finally know, so that now you can do something about it. If you are spending almost exactly the same as you make, you are doing a great job by not spending more than you make. If you are earning more than you spend, that is even better, because now you can find ways to stay within your income and start saving by the 50/20/30 Budget Rule.

A Store to Create a Budget. Reach Financial Freedom!

Prioritize

Not everything you spend money on every month is necessary. You have to pay for rent and utilities, but you don't necessarily have to pay for cable TV. There are alternative, cheaper ways to watch the movies and shows you love. Consider getting Netflix or taking advantage of your Amazon Prime membership via Amazon Prime Video.

You may have to pay for internet at home, so that you can do work or your children can do schoolwork at home, but you do not necessarily need to pay for the absolute fastest connection possible. Even with the basic plan, you can still check emails, surf the web, and do work; you just may not be able to have a different family member streaming shows in their rooms all at the same time.

Which expenses are really necessary for you and your family? Are there places that you can easily cut back? There is always a way to cut down on your expenses by prioritizing what is really important, or necessary to your household. Prioritizing your spending can allow you to maintain your current standard of living, while at the same time saving more money for your personal financial goals.

Make the Tough Choices

Following a comprehensive budget means having to make the tough choices. Because prioritizing isn't enough. After you make a list and prioritize, then it is time for real action. It is time to put your new goals and priorities into motion. Sometimes this can mean making tough choices.

Maybe you prefer eating out, because it means you don't have to cook for yourself or because maybe you aren't a very good cook yourself. But if you are saving money, such as for a new house, a family vacation, or your child's college fund, then you might have to give up certain luxuries.

This doesn't mean giving up everything you love though. It could just mean moderation. If you love eating out, try to cut back to just once or twice a week, rather than going out every night, or try sharing a meal with your partner. Many restaurants serve meals with very large portions, which are too large for the average person to eat alone. Share a meal with a loved one, or take the leftovers home for lunch the next day, instead of leaving the leftovers to be thrown away.

When making tough decisions in order to follow your budget, make sure to do so with the help of an emotional balance sheet. Don't forget: you are making and following a budget because you are trying to make your own financial goals. This is for you. There are so many different factors that go into making financial decisions, apart from just the bare numbers and calculations. You may find that, in some situations, "the emotional benefits of something far outweigh the financial ones." In this case, it could be to your benefit to use an emotional balance sheet to assist you in making some of these tough choices.

Conclusion

There are almost as many budgeting tips as there are people who use budgets to manage their income. The great thing is that all the budgeting rules are at your fingertips, and you can make choices once you see which rules work best for you. The most important thing to always keep in mind is that you have created your budget so that you can be in control. Especially if you have a low income, you can use your budget to start achieving your financial goals.

The ol' 50/20/30 Budget Rule really works, so make it work for you and your family. Not only is the 50/20/30 Budget Rule simple and easy to follow, but it allows you to control your budget on your own terms. You don't have to cut fun out of your life for the 50/20/30 Budget Rule, you just have to prioritize how you spend your money and focus on moderation.